How to Achieve Immense Personal Fortune: Strategies for Long-Term Wealth Building

Achieving immense personal fortune is a goal that many aspire to, but it requires more than just luck or a sudden windfall. It demands discipline, strategic thinking, and a long-term commitment to financial growth. Whether you're just starting out or looking to improve your current financial situation, building wealth is a journey that involves careful planning, consistent effort, and the right mindset. In this article, we’ll explore actionable strategies to help you build lasting wealth and achieve financial independence.

Define Your Vision of Financial Freedom

Financial freedom isn’t one-size-fits-all. For some, it may mean retiring early, while for others, it’s about living debt-free or having the flexibility to pursue their passions. Start by envisioning your ideal financial life. What would you do if money wasn’t a constant concern? This clarity will guide your efforts as you work toward achieving your goals.

Key Steps:

- Understand what financial freedom means to you.

- Set clear, achievable goals that align with your vision.

- Break down your goals into smaller, manageable steps to stay motivated.

Assess Your Current Financial Situation

Understanding where you stand financially is crucial when it comes to building wealth. A clear picture of your assets, liabilities, and income will help you make informed decisions and track your progress over time.

Key Steps:

- Calculate your net worth by listing all your assets (cash, investments, property) and subtracting your liabilities (credit card debt, student loans, mortgages).

- Track your expenses using budgeting apps or spreadsheets to identify areas where you can cut back.

- Review your income sources to determine how much you can realistically save or invest.

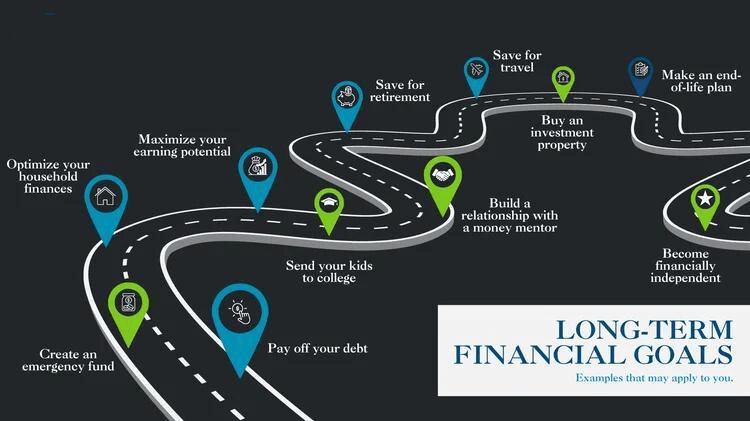

Set Clear Financial Goals

Goals give direction to your financial journey. Whether short-term or long-term, setting specific, measurable, and time-bound goals ensures that your efforts are focused and actionable.

Key Steps:

- Define your short-term goals (e.g., saving for a vacation, building an emergency fund).

- Set long-term goals (e.g., buying a home, funding your child’s education, retiring comfortably).

- Use the SMART framework to create goals that are Specific, Measurable, Achievable, Relevant, and Time-bound.

Create a Realistic Budget

A budget is your roadmap to financial success. Allocating your money wisely helps you balance spending and saving, ensuring that you’re on track to meet your financial objectives.

Key Steps:

- Apply the 50/30/20 rule to divide your after-tax income into necessities, discretionary spending, and financial goals.

- Categorize your expenses to understand where your money goes each month.

- Set spending limits for each category based on your priorities and goals.

- Use budgeting tools like Mint or YNAB to simplify tracking and organization.

Eliminate Debt

Debt can be a major obstacle to financial freedom. Developing a systematic plan to pay off high-interest debts will free up more money for savings and investments.

Key Steps:

- Prioritize high-interest debt such as credit cards or payday loans.

- Choose a debt repayment strategy (debt avalanche or snowball method) that suits your personality and financial situation.

- Negotiate with creditors to potentially lower interest rates or payment terms.

Build an Emergency Fund

An emergency fund acts as a financial safety net during unexpected events. Having 3–6 months’ worth of living expenses saved in an accessible account can protect you from financial shocks.

Key Steps:

- Determine your emergency fund goal based on your job stability and living expenses.

- Open a high-yield savings account to earn more interest on your emergency fund.

- Consistently contribute to your emergency fund until you reach your target.

Start Investing Early

Investing is one of the most powerful ways to grow wealth over time. The earlier you start, the more time your money has to compound and grow.

Key Steps:

- Choose the right investments based on your risk tolerance and financial goals (e.g., index funds, ETFs, stocks, real estate).

- Diversify your portfolio to spread risk across different asset classes.

- Consider consulting a financial advisor for personalized guidance and investment strategies.

Increase Your Income

More income provides greater financial flexibility. Exploring new opportunities to boost your earnings can accelerate your path to wealth.

Key Steps:

- Find side hustles such as freelancing, tutoring, or selling handmade products.

- Upskill or reskill by taking online courses or earning certifications in high-demand fields.

- Explore passive income streams like rental properties or dividend-paying stocks.

Automate Your Finances

Automation simplifies money management and ensures consistency in your financial habits.

Key Steps:

- Set up automatic transfers from your checking account to savings or investment accounts.

- Use auto-pay for recurring bills to avoid late fees and maintain a good credit score.

- Automate percentage increases in your retirement contributions to build wealth over time.

Live Below Your Means

Spending less than you earn is essential for long-term financial health. Making intentional choices about your lifestyle allows you to allocate more resources toward your financial goals.

Key Steps:

- Adopt a minimalist lifestyle to reduce unnecessary expenses.

- Cook at home to save money and eat healthier.

- Shop smart by using coupons, comparing prices, and taking advantage of sales.

Educate Yourself Financially

Knowledge is power when it comes to managing money. Continuously learning about personal finance helps you make better decisions and avoid costly mistakes.

Key Steps:

- Read personal finance books and blogs such as Rich Dad Poor Dad or The Total Money Makeover.

- Listen to finance podcasts like The Dave Ramsey Show or The Smart Passive Income Podcast.

- Stay updated on financial trends and best practices through reputable sources.

Conclusion

Achieving immense personal fortune is a journey that requires thoughtful planning, consistent effort, and the right tools. By assessing your current financial situation, setting clear goals, and adopting strategies like budgeting, eliminating debt, and investing early, you can build a strong foundation for wealth and independence. Incorporating habits such as living below your means, automating finances, and continuously educating yourself about money management will keep you on track. Start taking actionable steps today to secure a prosperous and stress-free future. Financial freedom is within your reach—make it your reality.

Post a Comment for "How to Achieve Immense Personal Fortune: Strategies for Long-Term Wealth Building"

Post a Comment