How to Achieve Financial Security and Stability: A Complete Guide

Financial security and stability are essential goals for individuals seeking long-term peace of mind and the ability to meet life’s challenges without undue stress. In a world where economic uncertainty is ever-present, understanding how to achieve financial security is more important than ever. This guide will walk you through practical steps, strategies, and insights to help you build a solid financial foundation.

Start Early and Stay Consistent

One of the most powerful tools in achieving financial security is time. The earlier you begin saving and investing, the more time your money has to grow through compound interest. For example, if you save $200 every month for 40 years at a 5% interest rate, you’ll accumulate significantly more than someone who starts saving the same amount for just 10 years.

Even if you’re close to retirement, it’s never too late to start. Every dollar saved helps, and small, consistent contributions can make a big difference over time. Treat your savings as a recurring expense, like paying rent or a car loan, to ensure it becomes a habit rather than an afterthought.

View Savings as a Priority

Many people struggle to save because they don’t treat it as a necessary expense. Instead, consider your retirement savings as a non-negotiable part of your budget. Automating your savings through payroll deductions or direct deposits can help you stay on track without having to remember to set aside money each month.

If your employer offers a 401(k) or similar retirement plan, take full advantage of it. Contributing to a tax-deferred account not only helps you save for the future but also reduces your taxable income, potentially lowering your tax bill.

Diversify Your Investments

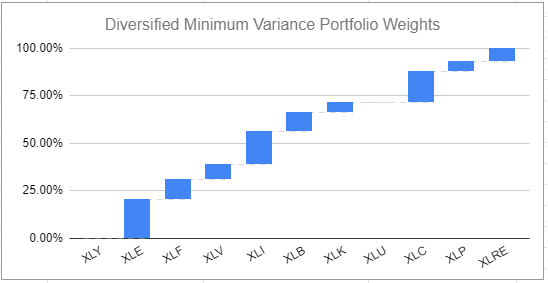

Diversification is key to managing risk and ensuring your investments can weather market fluctuations. Rather than putting all your money into one type of investment, spread it across different asset classes such as stocks, bonds, real estate, and cash equivalents.

Your investment strategy should align with your age, risk tolerance, and financial goals. Younger investors may afford to take on more risk, while those nearing retirement may prefer a more conservative approach. Regularly reviewing and rebalancing your portfolio ensures it stays aligned with your evolving needs.

Plan for All Expenses

When planning for retirement, it’s easy to overlook expenses like medical care, long-term care, and taxes. These costs can add up quickly and significantly impact your financial security. Make a list of all potential expenses and factor them into your retirement savings calculations.

Additionally, consider the cost of living in your desired retirement location. Housing, utilities, and healthcare costs vary widely, so it’s crucial to have a realistic understanding of what you’ll need to cover.

Live Within Your Means

Living within your means is a foundational principle of financial stability. It involves spending less than you earn and avoiding unnecessary debt. Tracking your income and expenses can help you identify areas where you can cut back and redirect funds toward savings.

Creating a budget using methods like the 50/30/20 rule (50% for needs, 30% for wants, 20% for savings and debt repayment) can provide structure and clarity. Regularly reviewing and adjusting your budget ensures it remains relevant as your financial situation changes.

Build an Emergency Fund

An emergency fund is a critical component of financial security. Aim to save 3-6 months’ worth of living expenses to cover unexpected events such as job loss, medical emergencies, or home repairs. Having this safety net prevents you from relying on high-interest debt during tough times.

Automating your emergency fund contributions can help you build it consistently. Even small amounts, when saved regularly, can add up over time and provide a valuable buffer against financial shocks.

Consider Professional Guidance

If you’re unsure about how to manage your finances effectively, consider working with a qualified financial planner. A professional can help you create a personalized plan that addresses your unique goals, risks, and circumstances.

Look for a planner who is certified and has experience in retirement planning, investment management, and tax strategies. Their expertise can help you make informed decisions and avoid costly mistakes.

Embrace Frugality and Smart Spending

Frugality doesn’t mean deprivation; it means making intentional choices that align with your financial goals. Simple habits like meal planning, buying in bulk, and using community resources can save you money without sacrificing quality of life.

Additionally, seeking out used items, prioritizing reliability over price, and finding free or low-cost activities can help you stretch your budget further. These practices not only reduce expenses but also promote sustainability and long-term value.

Conclusion

Achieving financial security and stability requires a combination of discipline, planning, and smart decision-making. By starting early, saving consistently, diversifying your investments, and living within your means, you can build a strong financial foundation that supports your goals and protects you from unexpected challenges.

Remember, financial security is not a destination but a continuous journey. With the right strategies and mindset, you can create a future filled with confidence, freedom, and peace of mind.

Post a Comment for "How to Achieve Financial Security and Stability: A Complete Guide"

Post a Comment