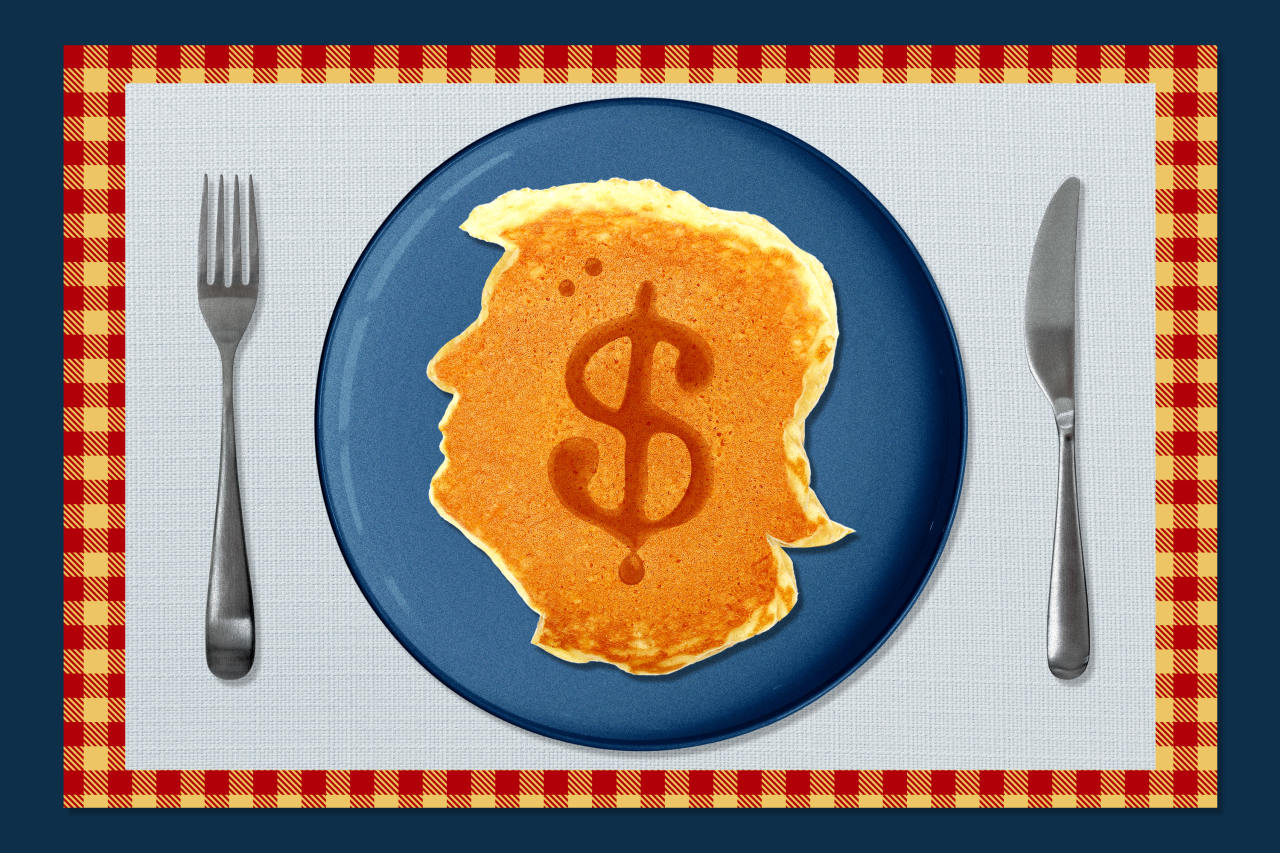

The Secret to the Trump Family's Crypto Wealth: PancakeSwap

The Trump Family’s Crypto Venture and Its Ties to Binance

The Trump family’s cryptocurrency venture has generated significant wealth since the election, with an estimated $4.5 billion in gains. This success is largely attributed to a partnership with PancakeSwap, a trading platform that operates under the umbrella of Binance, the world's largest cryptocurrency exchange. Binance's founder, Changpeng Zhao, is reportedly seeking a pardon from President Trump, according to sources familiar with the matter.

PancakeSwap functions as an incubator for new cryptocurrencies, encouraging traders to use coins issued by the Trump family’s main crypto company, World Liberty Financial. The more widely USD1, World Liberty’s flagship coin, is used, the higher its circulation and the greater the profits for the company and its owners, including the Trump family.

PancakeSwap is a digital marketplace where users trade USD1 with other newly created currencies like Torch of Liberty and Eagles Landing. These coins, which have patriotic names, were launched this year with the stated goal of increasing the usage of USD1. Traders, many of whom communicate in Chinese, gather on the Telegram messaging app to discuss rewards offered by PancakeSwap to top users of USD1.

World Liberty and PancakeSwap announced their partnership in June to boost the adoption of USD1. While such reward systems are common in the crypto industry—similar to free trades from brokerages or chips at casinos—the details of Binance's involvement in creating PancakeSwap were not disclosed at the time. According to insiders, Binance employees developed the platform internally.

Changpeng Zhao, who was previously jailed in the U.S. for four months after Binance agreed to pay a $4.3 billion fine for money laundering, has been working to secure a pardon from Trump. Zhao, one of the richest people in the crypto industry, recently hired Ches McDowell, a lobbyist and friend of Donald Trump Jr., to push for the pardon.

World Liberty, which was launched during the presidential campaign, aims to make America the crypto capital of the world. The company unveiled USD1 in March, claiming it would help protect the U.S. dollar's status as the global reserve currency. Binance played a key role early on, accepting a $2 billion investment in World Liberty coins that significantly boosted USD1's circulation.

USD1 is a stablecoin, backed 1:1 by U.S. dollars. The funds backing these coins are invested in government bonds and money-market funds, with no interest paid to users. With over $2 billion in circulation, USD1 generates around $80 million annually. Binance holds this amount on its platform, ensuring continued earnings for World Liberty.

Trump and his family own 40% of World Liberty. A stake in one of the company’s cryptocurrencies is worth $4.5 billion, according to recent disclosures.

Ties to China and Global Markets

World Liberty’s relationship with PancakeSwap and Binance is part of a broader network involving entities and individuals with strong ties to China. One of the company’s largest investors is Justin Sun, a Hong Kong-based billionaire. This connection comes even as the White House pursues a trade war against China and seeks to limit U.S. corporate ties to the country.

China is Binance’s largest market by trading volume, and the company has long maintained that it is not a Chinese entity. However, Binance has been based in Shanghai, and Zhao claims to hold Canadian and United Arab Emirates citizenship. The company has employees worldwide but no official headquarters.

Eric Trump, the president’s son and co-founder of World Liberty, plans to meet potential partners in Hong Kong in August during a bitcoin conference. The company has also discussed taking an investment from HashKey, a Hong Kong-based crypto-service provider owned by the Chinese conglomerate Wanxiang Group. A HashKey spokeswoman said discussions were exploratory and no commitments had been made.

Building a Market

Crypto companies release thousands of new coins each year, but most fail to gain traction. To attract traders, new coins need high trading volumes. PancakeSwap stepped in, helping USD1 reach massive trading levels. According to data, USD1 trading on PancakeSwap exploded from tens of millions to over $1 billion daily.

This surge was driven by a “Liquidity Drive” offering prizes up to $1 million for generating the most USD1 trading. Researchers and participants noted that demand wasn’t for payments or holding crypto, but for rewards. Binance also supported USD1 through its Binance Alpha program, promoting it among users.

Eagles Landing, Torch of Liberty, Tagger, and another token won the contest, splitting the $1 million prize. They distributed rewards to their users who traded USD1 the most. The website for Eagles Landing features a cartoon of a bloodied Trump, though its administrators remain anonymous.

These developments highlight the complex web of relationships between the Trump family’s crypto ventures and major players in the global crypto market.

Post a Comment for "The Secret to the Trump Family's Crypto Wealth: PancakeSwap"

Post a Comment