Snowflake's Growing Client Base Boosts Future Prospects

Snowflake's Strategic Growth in Enterprise Data Infrastructure

Snowflake has been strengthening its position in the enterprise data infrastructure market, driven by a surge in demand for AI-led analytics, collaboration, and scalable computing solutions. The company’s usage-based pricing model allows businesses to expand flexibly across various workloads, making it an attractive option for organizations looking for adaptable cloud solutions. However, long-term success will likely depend on sustained customer commitments and the momentum of multi-year contracts.

In the first quarter, Snowflake reported a total of 11,578 customers, with 606 of them generating over $1 million in trailing 12-month product revenue. Analysts, according to the Zacks Consensus Estimate, expect the number of customers to rise to 634 in the second quarter, marking a 24% year-over-year increase. This growth highlights the company’s continued traction, especially among large enterprise accounts.

Another key metric that reflects Snowflake’s performance is Remaining Performance Obligations (RPO). In the first quarter of fiscal 2026, RPO increased by 34% year-over-year to $6.7 billion. RPO represents the value of signed contracts that have not yet been billed, serving as a critical indicator of future revenue visibility and sustained demand. Analysts predict that RPO will reach $6.84 billion in the second quarter, up 31% from the previous year.

The company’s expanding product suite and strategic integrations are expected to drive further growth in RPO. Snowflake is enhancing its AI-native capabilities through products like Cortex AISQL, SnowConvert AI, Openflow, and new Agentic products available in the Marketplace. Additionally, the acquisition of Crunchy Data has bolstered its Postgres offering, while the partnership with Acxiom is anticipated to scale AI-driven marketing use cases. These developments are helping Snowflake gain traction with major enterprise clients such as Siemens, AstraZeneca, and Samsung Ads.

With rising RPO, expanding platform utility, and strong engagement with enterprises, Snowflake appears well-positioned to deliver consistent growth throughout fiscal 2026.

Intensifying Competition in the Market

Despite its progress, Snowflake faces growing competition from major players like Microsoft and ServiceNow, both of which are expanding their presence in enterprise-grade AI workflows. Microsoft is scaling Azure Synapse and Fabric to unify analytics, storage, and foundation model access. With native integration of OpenAI and a comprehensive cloud stack, Microsoft is emerging as a formidable competitor to Snowflake in data-driven AI deployments.

ServiceNow is also gaining momentum with Now Assist, a tool that embeds generative AI directly into IT, HR, and customer service workflows. Now Assist offers grounded copilots and low-code automation, which mirror some of the enterprise use cases addressed by Snowflake’s Cortex. As these companies continue to enhance their AI capabilities, Snowflake may need to accelerate its product development cycles and deepen in-platform integration to maintain its competitive edge.

Stock Performance and Valuation Metrics

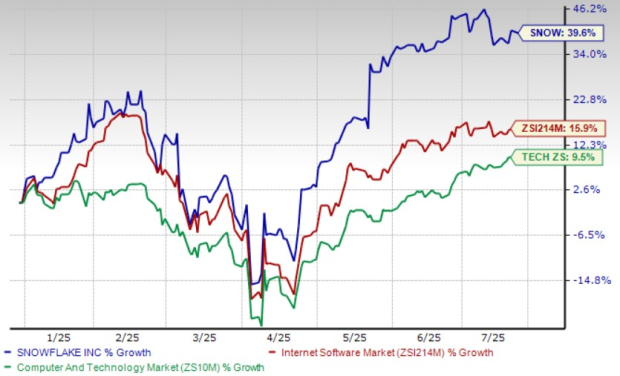

Snowflake shares have seen significant gains, rising 36.9% year-to-date. This outperforms the broader Zacks Computer & Technology sector, which returned 9.5%, and the Zacks Internet Software industry, which saw a 15.9% increase.

Currently, Snowflake stock is trading at a premium, with a forward 12-month Price/Sales ratio of 14.43X, compared to the industry average of 5.79X. The company has a Value score of F, indicating a weaker valuation relative to peers.

Analysts’ Zacks Consensus Estimate for Snowflake’s fiscal 2026 earnings stands at $1.06 per share, unchanged over the past 30 days. This figure represents a 27.71% increase compared to the previous year. Snowflake Inc. currently holds a Zacks Rank #3 (Hold), suggesting a neutral outlook from analysts.

Post a Comment for "Snowflake's Growing Client Base Boosts Future Prospects"

Post a Comment