Google Earnings: The Most Affordable of the Magnificent 7

Alphabet's Q2 Earnings Report: A Test of Resilience and Growth

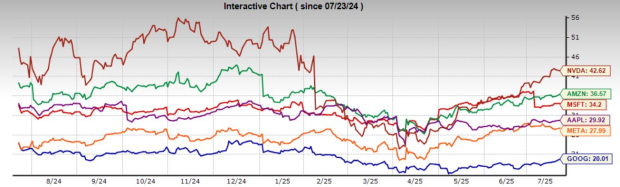

Alphabet is set to release its second-quarter earnings report on July 23, a moment that could define the company’s trajectory in the coming months. While the stock has remained relatively flat year-to-date, it has not kept pace with some of the leading tech giants like Nvidia, Microsoft, and Meta Platforms. However, it is performing in line with Amazon and significantly better than Tesla and Apple. Despite this mixed performance, Alphabet may now be one of the most attractively priced stocks among the so-called Magnificent 7.

At just 20 times forward earnings, Alphabet’s stock trades well below its 10-year median of 25.8x, offering an attractive valuation discount in a market where many AI-driven stocks command high premiums. This valuation gap has sparked interest from investors who are looking for opportunities in the tech sector. However, skepticism remains, particularly regarding concerns about search cannibalization from AI tools such as ChatGPT and Claude. While these fears dominate headlines, the data has yet to confirm any significant erosion in Alphabet’s search business, making this a key metric to watch during the upcoming earnings report.

Earnings Outlook and Analyst Expectations

According to recent data from Zacks, Alphabet is expected to report revenues of $79.25 billion for the second quarter of 2025, reflecting an 11.06% increase compared to the same period last year. The earnings per share (EPS) is forecasted at $2.14, representing a 13.2% year-over-year growth. Analysts have maintained stable estimates in recent weeks, indicating confidence in the company’s performance heading into the report.

Currently, Alphabet holds a Zacks Rank #3 (Hold) rating, with current quarter earnings estimates rising by 1% in the past week, next quarter estimates increasing by 1.85%, and next year estimates declining by 1.3%. Over the past four quarters, Alphabet has consistently exceeded earnings expectations, including a 39.11% beat in the last quarter. For the upcoming report, the Zacks Earnings ESP suggests a potential beat of 0.87%.

Google Search: A Core Engine Under Scrutiny

Search remains a cornerstone of Alphabet’s business and a focal point for investor concerns. The rise of large language models (LLMs) has raised questions about whether traditional web search could be disrupted. So far, however, Google Search appears to be holding strong, even as competitors attempt to innovate around it. Investors will be closely watching this quarter’s commentary on ad spending trends and search monetization.

Despite the concerns, Alphabet has a key advantage: its vast repository of proprietary and real-time internet data. This data fuels Gemini, Alphabet’s native AI model, giving it a competitive edge in retrieval-augmented generation (RAG), an increasingly important aspect of commercial AI use.

YouTube: The Silent Growth Engine

If search is Alphabet’s cash cow, YouTube may be its silent growth engine. Nielsen data shows that YouTube has steadily increased its share of U.S. TV viewing time and now surpasses major players like Disney, NBCUniversal, Paramount, and even Netflix. This reflects a generational shift in media consumption habits, and with the integration of Shorts and AI-powered content tools, YouTube continues to dominate the video content space.

YouTube’s ad monetization trends will also be a key figure to watch. After a brief slump during the digital ad slowdown in 2023, revenue trends have rebounded, and a strong showing this quarter could significantly boost investor sentiment.

Google Cloud: A Growing Force

Once a drag on profitability, Google Cloud has become a meaningful contributor to Alphabet’s bottom line. In Q1 2025, Google Cloud generated $12.3 billion in revenue, marking a 28% year-over-year increase. This impressive growth has been driven by a surge in enterprise demand for AI infrastructure, model hosting, and generative AI tools.

Recent developments highlight this momentum. Notably, OpenAI, despite its ties to Microsoft, struck a landmark cloud deal with Google, underscoring Alphabet’s growing credibility and competitiveness in AI infrastructure services. Google Cloud has also been chipping away at market leaders like Amazon and Microsoft, expanding its global market share to 11% in Q1, up from 10% in Q4 2024. While Amazon Web Services (AWS) remains the dominant player, its share slipped to 30%, down one percentage point, indicating that Microsoft Azure and Google Cloud are gaining traction.

Valuation and Long-Term Prospects

Despite its flat year-to-date performance and bearish sentiment, Alphabet is not broken. At just 20 times forward earnings, the stock is expected to grow earnings at a rate of 15% annually over the next three to five years. With major franchises like YouTube and Google Cloud gaining steam, the stock may be setting up for a strong second half.

While risks remain, particularly around competitive threats in AI and potential search cannibalization, Alphabet’s scale, balance sheet strength, and breadth of monetizable assets suggest the long-term case remains intact. With low expectations, a compelling valuation, and solid earnings momentum, GOOGL might just be the most overlooked of the Magnificent 7 heading into Q2 earnings.

Post a Comment for "Google Earnings: The Most Affordable of the Magnificent 7"

Post a Comment